What is the risk level of a certificate of deposit?

Answer. A certificate of deposit usually has limited liquidity. CDs are generally regarded as low-risk investments, providing stability and predictable returns. They offer a fixed rate of return, meaning the interest rate remains constant throughout the term of the CD.

Folks that use certificates of deposit to safely store their money tend to do so to avoid the risk associated with stock and bond investments. For longer-term investors, CDs may present a different type of risk—that the interest they offer does not keep up with the rate of inflation.

Level 3- These are investments where values are derived from techniques in which one or more significant inputs are unobservable. The Company's investments in marketable securities consist primarily of investments in certificates of deposit and equity securities.

Low-risk way to invest.

In fact, certificates of deposit are better than low-risk — there is almost no risk. The risks include bank failure and the risk that interest rates go higher while you're locked in.

Why are CDs considered low-risk? The return on a CD is tied to the interest rate you are offered. CDs usually feature fixed interest rates, which means overall volatility will not impact the performance of your savings. This is opposed to the price of a security, like a blue-chip stock.

Time deposits, certificates of deposit and commercial paper included in cash equivalents are valued at amortized cost, which approximates fair value. These are included within cash equivalents as a Level 2 measurement in the tables below.

Certificates of deposit are considered to be one of the safest savings options. A CD bought through a federally insured bank is insured up to $250,000. The $250,000 insurance covers all accounts in your name at the same bank, not each CD or account you have at the bank.

Potential risks with brokered CDs

The risk is that the issuer will exercise a call option at an unfavorable time for the holder, such as when interest rates decline.

However, CDs don't always beat out Treasurys, according to David Rosenstrock, CFP and director of Wharton Wealth Planning. This is due to reinvestment risk—if interest rates fall after your CD matures, you'll be forced to reinvest your funds at a lower rate.

CDs are one of the safest savings or investment instruments available for two reasons. First, their rate is fixed and guaranteed, so there is no risk that your CD's return will be reduced or even fluctuate. What you signed up for is what you'll get—it's in your deposit agreement with the bank or credit union.

What is Level 1 Level 2 and Level 3 investments?

Level 1 assets are those that are liquid and easy to value based on publicly quoted market prices. Level 2 assets are harder to value and can only partially be taken from quoted market prices but they can be reasonably extrapolated based on quoted market prices. Level 3 assets are difficult to value.

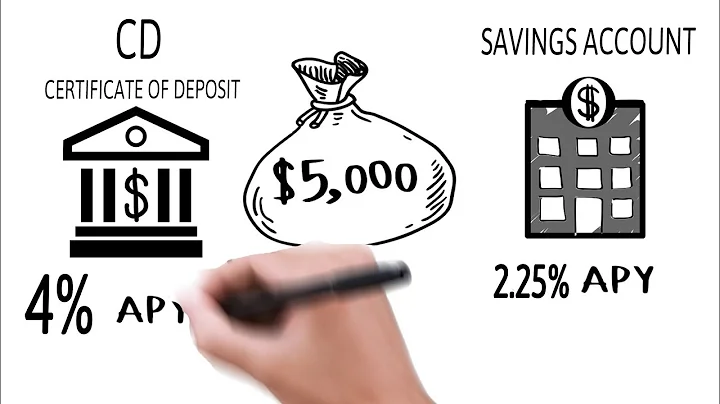

CDs are best for individuals looking for a guaranteed rate of return that's typically higher than a savings account. In exchange for a higher rate, funds are tied up for a set period of time and early withdrawal penalties may apply.

Like other deposit accounts, CDs are insured by the FDIC, a program that protects consumers in case the bank fails. As long as a bank is FDIC-insured, every deposit account is automatically insured up to $250,000 per depositor and ownership category.

The short answer is yes. Like other bank accounts, CDs are federally insured at financial institutions that are members of a federal deposit insurance agency. If a member bank or credit union fails, you're guaranteed to receive your money back, up to $250,000, by the full faith and credit of the U.S. government.

Not likely. Many experts agree there's a good chance CD rates have topped out for now, and rate cuts may take place later on in 2024.

- Lafayette Federal Credit Union – 5.56% APY.

- Salem Five – 5.55% APY.

- CIBC Agility – 5.51% APY.

- DR Bank – 5.50% APY.

- nbkc – 5.50% APY.

- TotalDirectBank – 5.50% APY.

- NexBank – 5.50% APY.

- Vibrant Credit Union – 5.50% APY.

“Consumers should be reassured that savings accounts and CDs are covered by FDIC [or NCUA] insurance up to $250,000. CDs are as safe as putting money in a savings account, and in most cases will provide a higher return,” says Rebell.

CDS contracts with higher liquidity exposures have higher expected excess returns for sellers of credit protection and trade with wider CDS spreads; on average, liquidity risk accounts for 24% of CDS spreads.

Why it's probably time to buy a CD. It's unlikely that CD rates will continue to climb any higher. Now, you can lock in high rates on both short-term and long-term CDs. Waiting to open a CD could mean missing out on some stellar rates.

Bottom line. While we don't yet officially know when, and by how much, interest rates could drop in 2024, it's safe to say we've reached peak savings rates today and now is the time to lock one in with a CD.

Do banks make money on CDs?

The bank makes profits by charging higher interest on money that is lent out than the interest that is paid to depositors. However, banks are obligated to pay back the depositors' funds whenever they withdraw it. Therefore, there is a risk that many depositors may withdraw their funds simultaneously.

| Top Nationwide Rate (APY) | Total Earnings | |

|---|---|---|

| 6 months | 5.76% | $ 288 |

| 1 year | 6.18% | $ 618 |

| 18 months | 5.80% | $ 887 |

| 2 year | 5.60% | $ 1,151 |

- Limited liquidity. One major drawback of a CD is that account holders can't easily access their money if an unanticipated need arises. ...

- Inflation risk. ...

- Comparatively low returns. ...

- Reinvestment risk. ...

- Tax burden.

CDs don't have monthly fees, but most have an early withdrawal penalty and don't let you add funds after the initial deposit. Like regular savings accounts, certificates of deposit are insured, so you get your money back in the unlikely event your bank goes bankrupt.

How often are callable CDs called? Callable CDs can be called on a CD's call dates, which are typically spaced six months apart. During the noncallable period, an issuer can't use its call feature. Typically, the first several months of a callable CD's term are noncallable.

References

- https://www.nerdwallet.com/article/banking/are-cds-safe

- https://www.marketwatch.com/picks/cd-vs-savings-account-which-should-i-choose-6cc7169d

- https://www.latimes.com/compare-deals/banking/savings/7-percent-interest-savings-accounts

- https://www.bloomberglaw.com/external/document/X74JVT5O000000/litigation-overview-initial-disclosures-under-rule-26-a-discover

- https://www.bankrate.com/banking/cds/paying-tax-on-cd-interest/

- https://www.ifrs.org/content/dam/ifrs/groups/iasb/guidance-for-developing-and-drafting-disclosure-requirements-in-ifrs-accounting-standards.pdf

- https://www.fluencetech.com/post/what-are-financial-statement-disclosures

- https://www.forbes.com/advisor/banking/cds/when-a-cd-matures/

- https://www.consumercomplianceoutlook.org/2010/fourth-quarter/understanding-regulation-dd

- https://www.bankrate.com/banking/cds/cd-early-withdrawal-can-come-at-a-high-price/

- https://www.fool.com/the-ascent/banks/articles/yes-you-can-lose-money-in-a-cd-heres-how/

- https://www.investopedia.com/terms/t/tax-exempt-sector.asp

- https://www.nasdaq.com/articles/can-you-transfer-your-401k-to-a-cd-how-to-avoid-penalties

- https://www.experian.com/blogs/ask-experian/pros-cons-cds/

- https://www.wasatchpeaks.com/blog/certificate-of-deposit-advantages-and-disadvantages

- https://www.federalreserve.gov/boarddocs/caletters/2010/1009/10-9-attachment.pdf

- https://www.forbes.com/advisor/banking/pros-and-cons-of-using-a-certificate-of-deposit-cd-for-your-savings/

- https://fortune.com/recommends/banking/are-cds-worth-it-right-now/

- https://www.businessinsider.com/personal-finance/5-percent-certificate-of-deposit-cd

- https://www.experian.com/blogs/ask-experian/short-term-vs-long-term-cds/

- https://www.cnn.com/cnn-underscored/money/how-much-money-should-i-keep-in-a-cd

- https://www.investopedia.com/what-can-i-earn-with-10k-in-a-cd-8400034

- https://quizlet.com/80817357/personal-finance-unit-4-flash-cards/

- https://www.investopedia.com/can-cds-bypass-probate-5272180

- https://www.cbsnews.com/news/how-much-does-1000-cd-make-in-a-year/

- https://www.discover.com/online-banking/banking-topics/4-benefits-of-certificate-of-deposit/

- https://www.cnn.com/cnn-underscored/money/are-cds-taxable

- https://financeunlocked.com/discover/glossary/level-1,-2,-and-3-assets-valuation

- https://www.investopedia.com/best-1-year-cd-rates-4796650

- https://study.com/academy/lesson/mandatory-federal-disclosures-in-real-estate.html

- https://money.com/what-is-a-certificate-of-deposit/

- https://www.pwc.com/us/en/services/trust-solutions/financial-statement-audit/disclosure-checklist.html

- https://www.quora.com/What-are-the-advantages-and-disadvantages-of-creating-CDs-DVDs-and-or-Blu-ray-discs-with-data-files-on-them-vs-keeping-your-files-on-an-external-hard-drive

- https://fortune.com/recommends/banking/are-cds-safe/

- https://www.sofi.com/learn/content/can-a-certificate-of-deposit-cd-lose-value/

- https://www.schwab.com/learn/story/explore-brokered-cds-vs-bank-cds

- https://www.forbes.com/advisor/banking/cds/cd-rate-forecast/

- https://time.com/personal-finance/article/what-is-a-cd-ladder/

- https://www.consumerfinance.gov/rules-policy/regulations/1030/4/

- https://www.mygov.scot/disclosure-types

- https://www.nerdwallet.com/article/banking/how-do-cds-work

- https://www.helpwithmybank.gov/help-topics/bank-accounts/fees-terms/terms/terms-disclosures.html

- https://www.consumerfinance.gov/rules-policy/regulations/1030/

- https://corporatefinanceinstitute.com/resources/wealth-management/certificate-of-deposit-cd/

- https://www.comerica.com/insights/personal-finance/Investing-in-CDs-as-a-Low-Risk-Means-to-Financial-Planning.html

- https://www.nerdwallet.com/article/banking/faq-cd-or-highyield-savings

- https://www.cbsnews.com/news/how-much-will-a-20000-cd-make-in-a-year/

- https://www.federalreserve.gov/boarddocs/caletters/2007/0707/07-07_attachment.pdf

- https://www.cnbc.com/select/why-now-is-perfect-time-to-open-cd/

- https://www.nerdwallet.com/article/banking/cd-rates-forecast

- https://www.cbsnews.com/news/can-you-lose-money-in-a-cd/

- https://www.sony-mea.com/electronics/support/articles/00027417

- https://www.thebalancemoney.com/certificate-of-deposit-rules-and-regulations-5224072

- https://www.investopedia.com/what-happens-to-your-cd-if-your-bank-fails-7511009

- https://fortune.com/recommends/banking/should-you-open-certificate-of-deposit-now-or-wait/

- https://www.cbsnews.com/news/why-you-should-put-10000-into-a-short-term-cd-right-away/

- https://www.investopedia.com/pros-and-cons-of-cds-5223947

- https://www.bankrate.com/banking/cds/cd-rate-forecast/

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-certificate-of-deposit-cd-en-917/

- https://www.annuity.org/personal-finance/banking/certificate-of-deposit/taxation/

- https://quizlet.com/214345125/financial-literacy-speed-back-assignment-2-flash-cards/

- https://ballotpedia.org/Truth_in_Savings_Act

- https://fortune.com/recommends/investing/pros-and-cons-of-certificates-of-deposit/

- https://www.investopedia.com/terms/r/regulation-dd.asp

- https://www.forbes.com/sites/forbesfinancecouncil/2023/07/11/the-risks-of-certificates-of-deposits-cds/

- https://www.investopedia.com/terms/c/certificateofdeposit.asp

- https://www.nerdwallet.com/article/banking/cd-certificate-of-deposit

- https://www.cbsnews.com/news/how-much-will-a-5000-cd-make-in-a-year/

- https://www.fool.com/the-ascent/buying-stocks/articles/will-you-lose-your-treasuries-if-the-us-defaults-on-its-debt-suze-orman-has-an-answer/

- https://www.forbes.com/advisor/banking/cds/best-1-year-cd-rates/

- https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

- https://www.businessinsider.com/personal-finance/are-cds-safe

- https://firstamendment.mtsu.edu/article/disclosure-requirements/

- https://www.cbsnews.com/news/can-you-avoid-taxes-on-cd-account-interest/

- https://www.usatoday.com/money/blueprint/banking/cds/cd-rates-forecast/

- https://www.nasb.com/blog/detail/advantages-and-disadvantages-of-a-cd

- https://www.investopedia.com/how-many-cds-can-i-have-5248694

- https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID2641214_code547533.pdf?abstractid=2371374&mirid=1

- https://lendedu.com/blog/certificate-of-deposit-advantages-and-disadvantages/

- https://www.cnbc.com/select/best-certificates-of-deposits/

- https://www.chase.com/personal/banking/education/budgeting-saving/cd-vs-savings-account

- https://www.bankrate.com/banking/cds/are-cds-worth-it-right-now/

- https://www.quora.com/Do-CDs-lose-info-over-time

- https://www.forbes.com/advisor/banking/cds/how-much-money-to-put-in-a-cd/

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/certificates-deposit-cds

- https://www.capitalone.com/bank/money-management/banking-basics/certificate-of-deposit-advantages-and-disadvantages/

- https://www.investopedia.com/how-does-a-cd-account-work-5235792

- https://www.helpwithmybank.gov/help-topics/bank-accounts/certificates-of-deposit/cd-penalties.html

- https://www.bankrate.com/banking/cds/cd-rates/

- https://www.investopedia.com/best-6-month-cd-rates-4783267

- https://www.sec.gov/Archives/edgar/data/98338/000121390020009073/R12.htm

- https://www.cbsnews.com/news/why-you-should-put-15000-into-a-1-year-cd-now/

- https://www.bankrate.com/banking/cds/the-pros-and-cons-of-cd-investing/

- https://www.forbes.com/advisor/banking/cds/callable-cd/

- https://www.keystonelawfirm.com/blog/do-inheritance-checks-get-reported-to-the-irs/

- https://fastercapital.com/content/Banking--Exploring-the-World-of-Call-Deposit-Accounts.html

- https://www.americanbullion.com/can-banks-seize-your-money/

- https://apps.irs.gov/app/understandingTaxes/hows/tax_tutorials/mod03/tt_mod03_glossary.jsp?backPage=tt_mod03_01.jsp

- https://materials.proxyvote.com/Approved/871829/20100914/AR_67757/PDF/sysco-ar2010_0070.pdf

- https://archives.ncdcr.gov/protect-your-dvds-and-cds/open

- https://www.investopedia.com/how-to-open-a-cd-5225191

- https://www.investopedia.com/ask/answers/060616/can-certificates-deposit-cds-lose-value.asp

- https://www.brtelco.org/talking-cents-financial-insights/certificate-of-deposit-advantages-and-disadvantages

- https://support.hp.com/us-en/document/ish_3940413-3174790-16